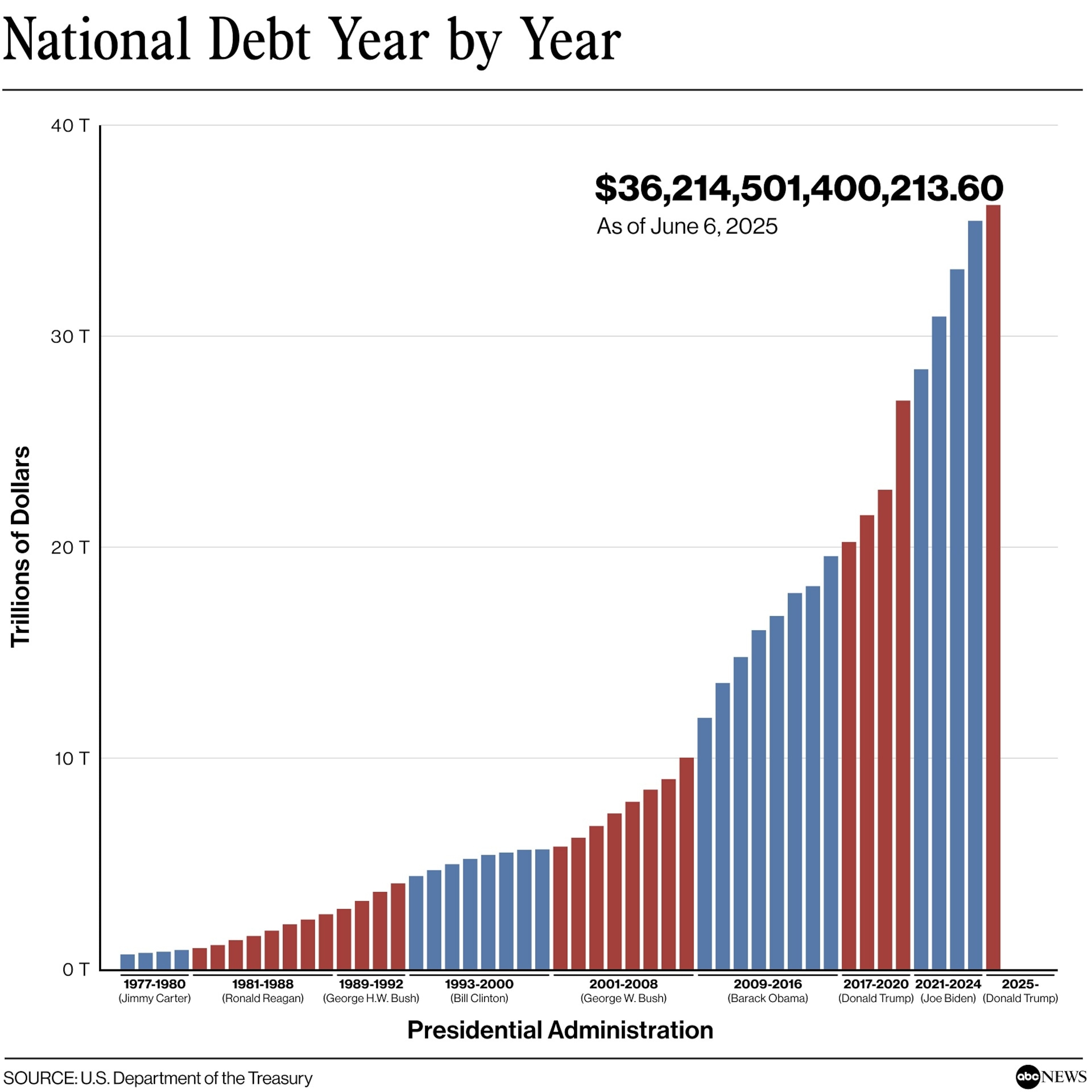

Before becoming personal attacks, the clash between President Donald Trump and Elon Musk began with a disagreement about the country’s balloon debt.

Musk publicly condemned what Trump expects his characteristic legislative achievement to be: a massive tax and immigration bill called Big Beaut Beautiful Bill Ley, as an “abomination” on its estimated impact on the deficit and debt.

The similar concern between a handful of hawks of republican budget in the Senate is complicating the path of the bill towards the passage through the desired deadline of Trump’s July 4.

The fuel was added to the fire when the non -partisan Congress budget office published its new score that estimated that the legislation would add $ 3 billion to the national debt during the next decade.

The debt, the total deficits and annual interests, is a historical maximum of $ 36 billion. Public debt measures of approximately 100% the size of the economy.

“We are at the levels of World War II at this time of government debt, and as far as the view is, we are just going up,” Kent Smetters, a professor at the Wharton Business School at the University of Pennsylvania, who previously worked at CBO A ABC News told ABC.

What to know about Trump’s Megabill CBO score

The non -partisan budget office estimated that the Megabill Trump approved by the Chamber would add $ 2.4 billion to the federal deficit during the next decade, in addition to generating $ 550 billion in interest costs.

“One Big Beautiful Bill Ley” estimated increases to national debt

Congress Budget Office, United States Treasury Department

Republican senator Ron Johnson, after the launch of CBO, told ABC News Live: “I refuse to accept deficits of more than $ 2 billion to the extent that the eye can see how the new normality.”

“I am worried about our children and grandchildren, the fact that we are mortgaging their future. It’s wrong. It’s immoral,” Johnson said.

The White House and Chamber leadership claim that CBO estimate is incorrect. The officials have accused the agency of political prejudices and disagree with the way in which they calculate the score without factoring in possible economic growth, which in a separate analysis at the end of this year.

Experts say criticism is not valid. They point out that the CBO is currently led by an official who served in the George W. Bush administration and that his estimates for this bill are not very far from independent models of banks or other external institutions.

“I think they know at some level that what they are doing is not fiscally responsible, so they are trying to blame the messenger for that message,” said Stan Veuger, a principal member of Economic Policy Studies at the American Enterprise Institute, a group of inclination experts to the right.

Veuger and Brendan Duke, the senior director of the Federal Budget Policy at the Budget and Policy Policies Center and policy, also emphasize that the CBO score is based on the written bill: when the expectation is that certain provisions of expenses and fiscal expenses and fiscal that the Republicans will expire in a few years will probably be extended, which will raise the fiscal cost of the bill.

Meanwhile, the CBO estimates that the Megabill could reduce taxes by $ 3.7 billion and reduce spending by $ 1.2 billion.

And Trump has promoted another analysis this week from the budget office that said that his tariff policy (which the president suggested could pay for some of his megabill priorities) that says that the income of the tariffs would reduce the deficit by $ 2.8 billion. Although this estimate assumes that tariffs would be permanently in their place, while Trump changed their policy several times and some of their rates actions are being challenged in court.

How the debt was so high and what could be the consequences

The national debt has shot in recent decades under democratic and republican administrations. Large tax cuts under Presidents Ronald Reagan, George W. Bush and Trump led to deficits; Like the stimulus packages, they passed due to the 2008 financial crisis and the 2020 Coronavirus pandemic.

National debt year after year

Treasury Department of the United States

To help pay Trump’s Megabill, Republicans are making changes in Medicaid and the supplementary nutritional assistance program. The non -partisan budget office estimates that millions of Americans will lose health insurance due to cuts.

“It’s one thing we asked Americans who give a little to reduce the deficit. But this does not reduce the deficit,” Duke said. “This increases the deficit and leaves millions of low and moderate income payments worse.”

Balance budget sheets completely would require much more drastic changes. All federal expenses would have to reduce 30% and taxes increased by 26%, or some combination of the two, immediately and forever, said Penn Wharton Smetters.

While many economists believe that some government debt is a good thing, since it means that many see US values as among the safest assets in the world, too much debt can have negative ramifications.

Experts said the possible consequences could be an increase in interest rates and problems with the bond market. It could also lead to lower salary growth and economic progress. A scenario in the worst case would be to breach the debt.

“The United States is definitely not too big to fail,” said Smetters. “When the failure occurs, what you see is a significant inflation, a significant pain is seen and you see social agitation.”